Benchmarking Study: 6 Key Takeaways for Financial Services Businesses

The financial services industry often gets lumped together as one single industry. In reality, though, financial services is an incredibly broad term that encompasses many different businesses—all with their own unique goals, challenges, and advertising needs.

We recently completed a benchmarking study of small/mid-size financial services businesses, seeking to better understand what those clients are currently focused on when it comes to using media to reach their target audience. While the study identified trends that seem consistent across all financial services industries, it also highlighted certain qualities and differentiating factors that separate not only one financial services sub-industry from another, but also distinguished top-performing advertisers from the rest of the pack.

With that in mind, here are six main takeaways from our financial services benchmarking study.

1. FINANCE DECISION-MAKERS MAKE MOST MEDIA BUYS IN SPRING AND SUMMER

Financial services industries experience their peak sales periods at different times during the calendar year, depending on the type of services they offer. While accountants and bookkeepers see the majority of their business in the first few months of the calendar year leading up to Tax Day, for example, bonding and surety businesses do their most sales in the fourth quarter of the calendar year.

Credit and mortgage services, meanwhile, as well as small and mid-sized banks, see most of their business between April and October, based on seasonal demand for mortgages, auto loan and student loans.

In general, the end of the calendar year is very slow for media buys among financial services businesses. The concentrated media buy activity can lead to seasonal swings in price increases when you’re trying to outbid your competition, but the relevance of this ad inventory means you’re likely to get more value out of that investment.

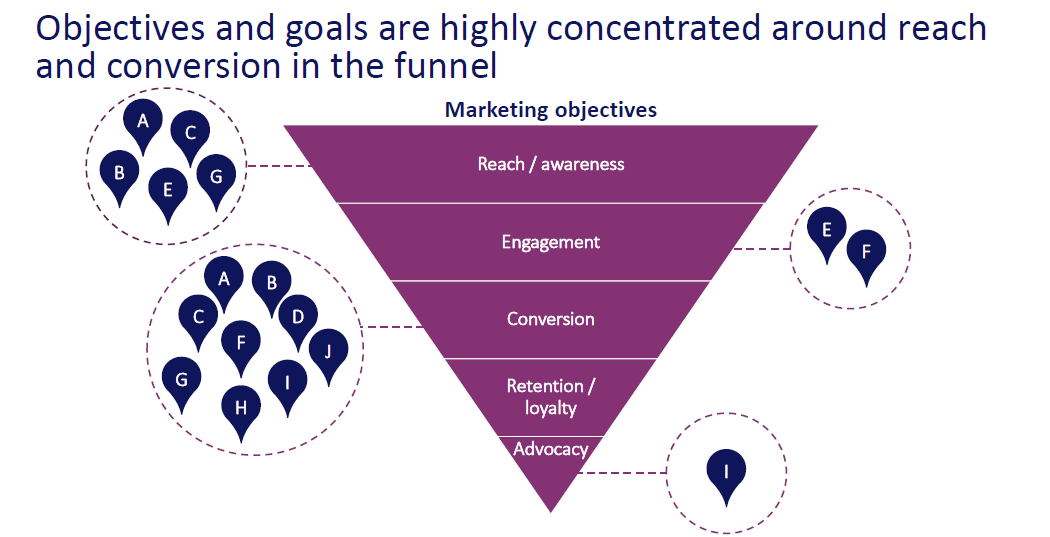

2. ADVERTISING OBJECTIVES AND GOALS ARE CONCENTRATED IN SPECIFIC FUNNEL STAGES

Any advertising campaign needs to be developed with objectives and goals in mind. These goals and their corresponding metrics provide a template for measuring the success and ROI of your campaigns.

Our survey of financial services businesses found that most of these objectives and goals are built around two stages of the funnel: reach and conversion.

This could be caused by several different factors. First, reach and conversions offer harder data points when trying to quantify performance and value for ad campaigns, which makes them easy stages to evaluate through goal-setting. But reach also directly reflects the efficacy of advertising campaigns in finding your target audience, and conversion directly impacts your revenue driven by that campaign.

While other stages can still be associated with objectives and goals, reach and conversion play the most prominent role for financial services businesses.

3. MEDIA BUYS UTILIZE A WIDE RANGE OF PRICING MODELS

Financial services businesses might show a slight preference for a cost-per-click pricing model, but it’s not the only method they use to determine a price for their media buys. Models such as cost-per-point are more commonplace when dealing with broadcast inventories, but an overarching trend seems to be that the pricing model used isn’t as important as the ability to know exactly what you’re paying for—and to reliably estimate the value of those media buys.

4. MEDIA PARTNERS DELIVER KEY DIFFERENTIATORS TO ELEVATE PERFORMANCE

When it comes to maximizing results from advertising campaigns, multiple benefits of media partners were cited by financial services business leaders. At the top of that list is the broad access to high-quality data, including the ability to offer end-to-end attribution that can also improve evaluations of different pricing models.

Those businesses also noted the ability for media partners to improve audience targeting and audience reach, to build campaigns within the context of established objectives and goals, and to build greater success through their extensive experience managing media buys for other financial services businesses.

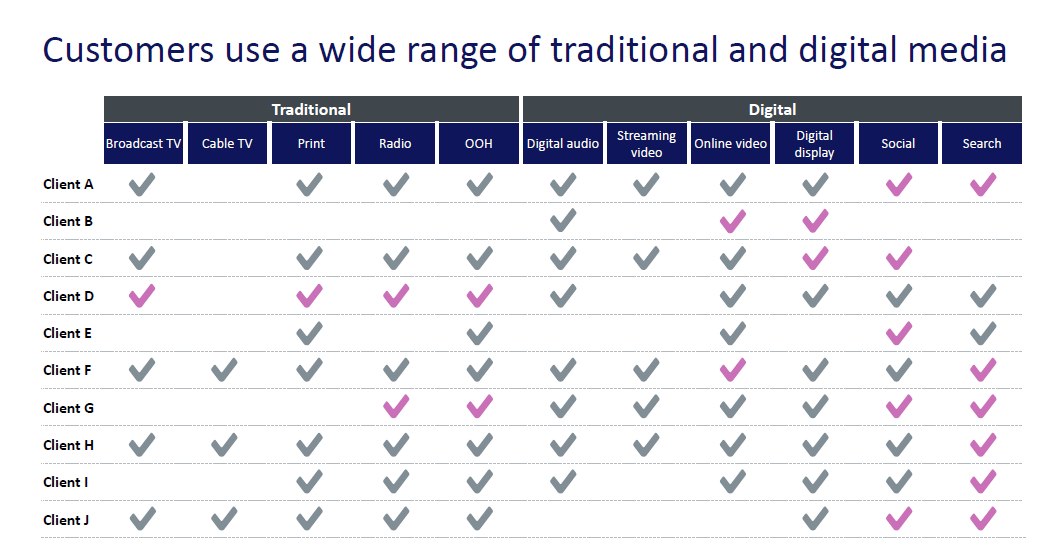

5. ADVERTISING STRATEGIES STILL USE A MIX OF TRADITIONAL AND DIGITAL MEDIA

There’s plenty of emphasis on digital channels and their importance to modern business advertising. But a breakdown of our clients surveyed found that traditional channels still play an integral role in overall ad strategy.

Grey check marks indicate capability used; pink check marks indicate a most-valued capability

While digital channels offer the benefits of more accurate attribution, advanced audience targeting and real-time measurement capabilities, financial services businesses are still finding value through traditional channels that offer massive audience reach—especially in print media, where financial services continues to have success connecting with its target customers.

TV also demonstrates particular value for businesses targeting regional and local audiences, including through cable TV inventories that offer more refined geo-targeting capabilities than broadcast alternatives.

6. SELF-SERVICE TOOL ADOPTION IS LOW, BUT CUSTOMER INTEREST IS HIGH

Self-service advertising tools have gained traction among SMBs for their ability to deliver effective ad solutions alongside detailed reporting, improved visibility, efficient media buying, and a more balanced partnership with media partners.

To this point, adoption of these self-service tools remains low—only one out of nine companies are currently using these tools. But every single company surveyed was interested in the potential of these self-service tools, suggesting that greater adoption of this media buying approach is on the horizon.

If your financial services business is looking for new ideas and a fresh approach to modern media advertising, you can learn a lot by studying the habits and strategies of your peers. Contact us today for a more comprehensive overview of the study; we’re happy to use these insights to grow your business together.

Connect with a Marketing Expert

Share Post On Social

Connect With Your Local Marketing Expert

You know your business. We know advertising. Together, we can bring your business to more people. Contact a member of our team today. We’d love to help you grow.