Audience Insights: Crossing the Streams

Among my many talents as a firmly entrenched Gen X-er* is the speed with which I can bellow out a reply if ever someone happens to ask, “Who you gonna call?”

“Ghost-BUST-ers,” I exclaim, trying in vain to recapture a touch of the rhythm from the Ray Parker, Jr. track that punctuated the 1984 film classic.

Beyond the catchy title tune, “Ghostbusters” the movie introduced the world to the iconic and oversized Stay Puft Marshmallow Man; and it taught us important life lessons like, for example, “don’t cross the streams.”

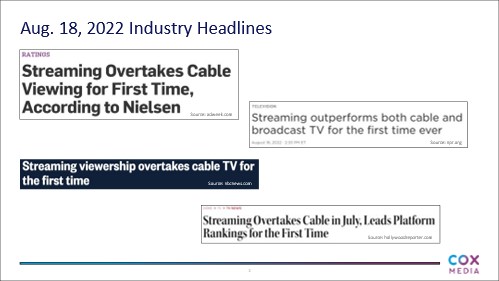

Well, now it seems that, while our Audience Insights team was away for the summer working on a new video series, a crossing of the streams of sorts has happened in the video world:

In the ghostbusting world, crossing the streams was undeniably bad. When it comes to the evolution of the video ecosystem, though, I tend to agree with Dr. Peter Venkman, who said, “I’m fuzzy on the whole good/bad thing.” Could Streaming growth actually be good for traditional TV – and maybe even great for advertisers?

Here at the Audience Insights desk, we believe the answer is yes, and here are four reasons why:

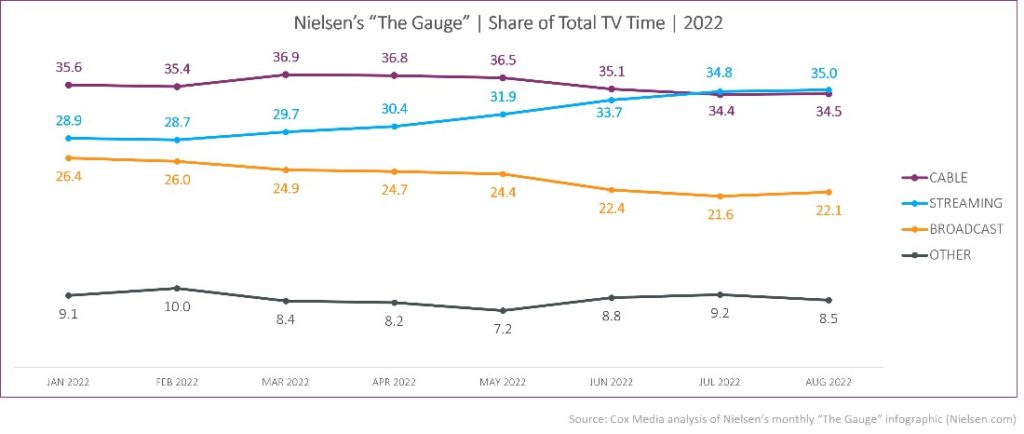

1. Growth of Streaming More a Complement to Cable Than a Replacement – As we noted in our final post of the summer, Streaming has definitely been on a hot streak in 2022. According to the latest release of The Gauge, a monthly Nielsen “macroanalysis” of video consumption across major TV delivery platforms, August marked the sixth straight increase in Streaming’s share of overall video consumption. While headlines have focused on the Streaming trend line overtaking the Cable line, Cable has maintained a stable viewing share amid the Streaming

surge. As a result, the gap between Cable and Broadcast has widened, with Cable garnering approximately 61% of traditional TV viewing time vs. 39% for Broadcast.

2. TV Time Remains Solid Among Cox Video Subscribers – For the month of August, Cox video homes consumed nearly seven hours of television per day, according to a Cox Media custom analysis of tuning data processed by Comscore. Average TV tuning time within these homes has remained consistent throughout 2022, and August 2022 was up slightly vs. August 2021.

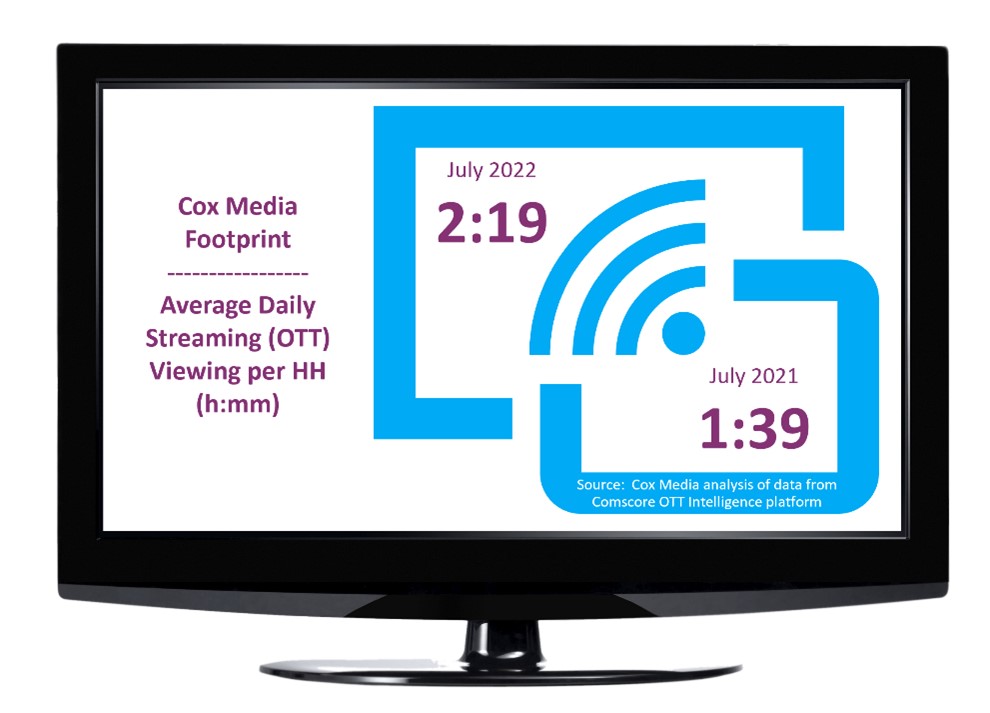

3. Cox Video Subscribers Finding More Time for Streaming – Based on Cox Media analysis of Comscore OTT Intelligence data for July 2022, Cox video households are not just watching traditional TV at a steady clip – they are finding additional room for Streaming on their video plates. Average Streaming consumption in these homes has increased by approximately 30 minutes per day vs. 2021.

4. Cox Video Subscribers Also Engaging More with On Demand Content – Cox Media analysis of data from Comscore’s OnDemand Essentials platform indicates a slight uptick in the average amount of time spent with video-on-demand (VOD) content. For August 2022, Cox video homes tuned in for more than 47 minutes per VOD transaction, compared to just under 46 minutes per transaction in August 2021.

Add it all up, and we start to see that the recent development of Streaming crossing the Cable trendline is far from a “total protonic reversal.” To the contrary, the swell of Streaming and the consistency of Cable create a powerful combo for reaching consumers. So much so that, if you’re a marketer wondering “who you gonna call” about your next campaign, you may want to put on your proton pack and proclaim, ”Cox Media!”

Connect with a Marketing Expert

Share Post On Social

Related Insights

Connect With Your Local Marketing Expert

You know your business. We know advertising. Together, we can bring your business to more people. Contact a member of our team today. We’d love to help you grow.